Ane Kathrine Christensen and Lucia Quaglietti, OECD Economics Department

Policy interest rates have risen at an unusually rapid pace since the end of 2021 in many countries. Such policy changes affect economic activity through many different channels. One key channel is the speed and extent to which changes in policy rates are passed through to financing conditions and credit growth, and thus to private consumption and investment (Bernanke and Gertler 1995; Mishkin 1996). Analysis in the June 2023 OECD Economic Outlook, suggests that changes in policy rates in OECD advanced economies are being quickly reflected in bank credit conditions faced by households and firms, with transmission occurring at a broadly similar pace to past tightening cycles.

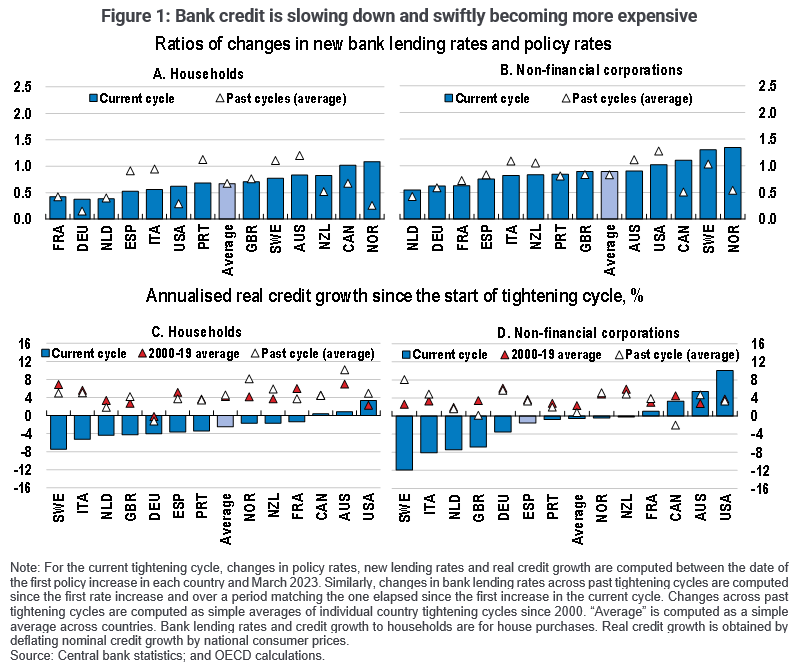

One indicator is the extent to which increases in policy rates have been transmitted into the interest rates on new bank loans for households and firms. The evidence suggests that transmission in the current cycle is similar to that in past tightening cycles on average, but with significant variation across countries (Figure 1, Panels A and B). In particular, there have been strong increases in the cost of new bank loans for non-financial corporations, where bank lending rates have on average increased almost one‑to‑one with policy rates. The largest relative increases in new bank lending rates have been observed in Australia, Canada, New Zealand, Norway and Sweden, in some cases reflecting an earlier start to policy tightening. In the euro area, bank lending rates charged on short-term loans to non-financial corporations have generally increased faster than those on loans with longer maturities and lending rates on consumer loans to households have risen less than rates on loans for house purchases.

Banks generally base the lending rates they charge to firms and households on their own funding costs, plus a mark-up. Rising policy rates have been quickly transmitted to interbank lending rates, but transmission to deposit rates has been sometimes slower. However, deposit rates have started to rise more rapidly recently, with banks trying to counteract tighter liquidity conditions and an acceleration in deposit outflows by offering higher rates to their customers.

Fast-rising bank lending rates have been associated with a slowdown in the pace of real credit growth (Figure 1, Panels C and D). On average, the slowdown in real credit growth during the current tightening cycle has been somewhat larger for households than for companies, though credit to firms has contracted sharply in a number of countries in the euro area and in the United Kingdom, while it has remained comparatively resilient in the United States and Canada. In the majority of the countries considered, credit growth has been weaker than at similar points in previous tightening cycles, and also lower than on average over 2000-19, particularly for households.

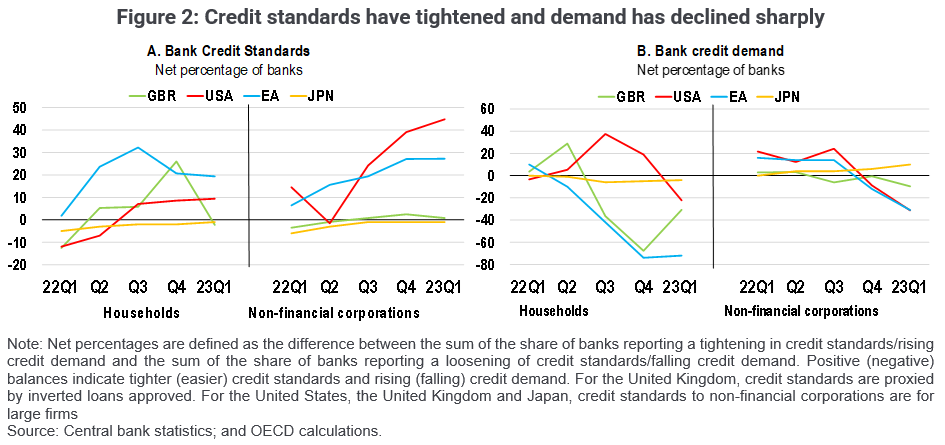

Monetary policy changes may also affect the willingness of banks to make credit available to potential borrowers. Bank lending surveys suggest that slowing credit growth and higher lending rates observed in the major advanced economies reflect a combination of tighter credit standards and falling credit demand (Figure 2). Credit standards have often tightened substantially in recent quarters, especially for mortgage lending in the euro area and for lending to non-financial corporations in the United States. Surveys point to a sharp decline in credit demand as well, especially for house purchase in the euro area and in the United Kingdom. In the euro area, the decline in credit demand for house purchases is similar to the fall seen during the global financial crisis. Japan is an exception, with credit standards and demand being little changed due to the continued accommodative monetary policy stance.

The pace of policy rate increases has now begun to slow in many countries, but bank credit conditions could tighten further in the coming quarters, with banks continuing to pass through higher funding costs to households and corporates. As a result, the full impact of policy tightening on activity is likely to appear with a lag over the course of 2023 and early 2024.

References

Bernanke, B., and M. Gertler (1995). "Inside the Black Box: The Credit Channel of Monetary Policy Transmission." Journal of Economic Perspectives, Vol. 9.

Mishkin F. (1996), "The Channels of Monetary Transmission: Lessons for Monetary Policy," NBER Working Papers 5464.

OECD (2023), OECD Economic Outlook, Volume 2023 Issue 1, OECD Publishing, Paris.

No comments:

Post a Comment