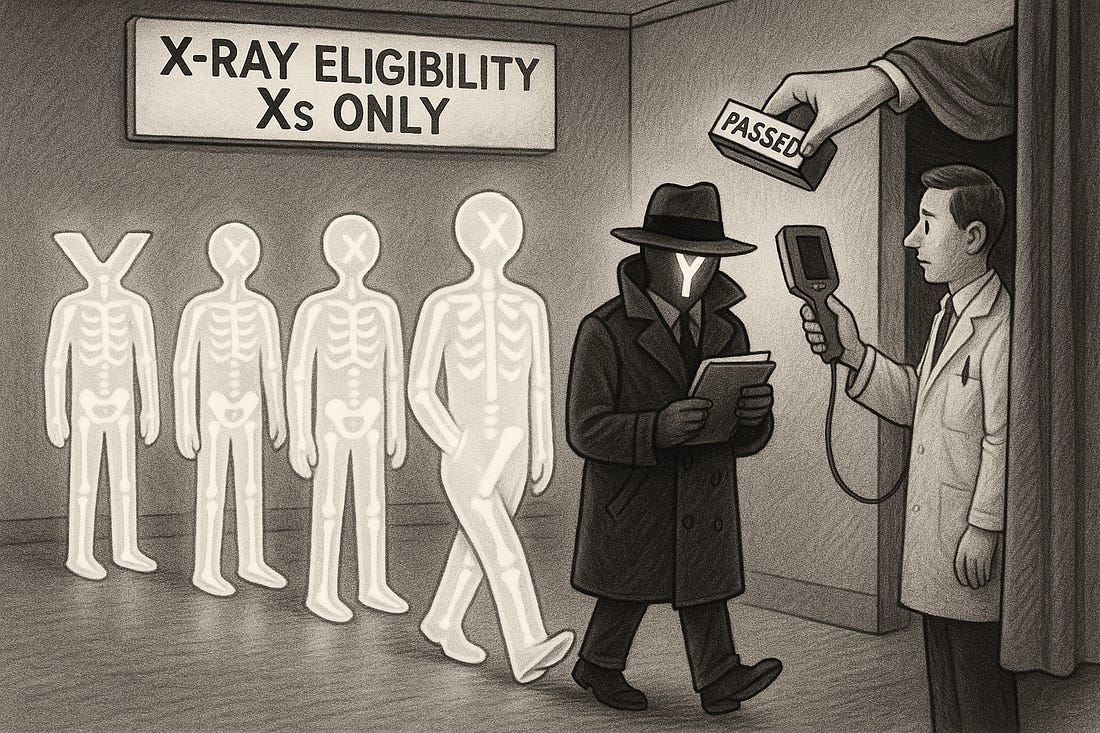

RIRA’s Return: Transparency Amid a Fog of ExceptionsRIRA followed the process—but the system that allowed it remains unclear, unequal, and overdue for reform.The rules weren’t vague. They weren’t unwritten. They weren’t hidden in fine print. They were clear: to receive a Public Purpose Fund grant administered by the New York Community Trust, your organization must be a 501(c)(3) public charity. Not a lobbying group. Not a neighborhood association. Not a 501(c)(4). And yet, in 2025, the Roosevelt Island Residents Association (RIRA) received a $10,000 grant. One Rule for All, One Technical PassThe Public Purpose Fund’s rules exist for a reason: to prevent public money from flowing to organizations engaged in lobbying or political activity. That’s why only 501(c)(3) charities—or entities fiscally sponsored by one—are eligible. RIRA is not a 501(c)(3). It’s a 501(c)(4)—a classification that allows for advocacy, political organizing, and lobbying. The distinction isn’t minor; it’s foundational. That’s why the only permissible workaround is fiscal sponsorship: when a verified 501(c)(3) assumes legal and financial responsibility for the project. RIRA President Frank Farance confirmed that RIRA used such a sponsor—RISA/Good Life, and that the process was disclosed to NYCT. He answered when others didn’t. That kind of transparency is a welcome departure from the norm and should be commended. But the deeper question remains unanswered: Is this a workaround that preserved accountability—or sidestepped it? If RISA is the fiscal sponsor, then RISA—not RIRA—is the legal recipient. That means RISA’s total grant allocation this year may be significantly higher than reported. It also means that an organization with a felony fraud history may be quietly responsible for overseeing funds directed at others. We can’t say for certain, because NYCT won’t clarify, and RISA has not responded. The structure may be technically compliant—but it fails the spirit of the law. And without public oversight, technical compliance isn’t enough. In a funding cycle defined by silence, Farance's transparency stood out. From Allocator to ApplicantRIRA once helped decide who received Public Purpose Fund grants. That role ended in 2022, when NYCT took over. In 2025, RIRA returned—not as a decision-maker, but as a recipient. The IRS lists RIRA as a 501(c)(4), with its last detailed financial disclosure filed in 2015. From 2016 through 2023, it submitted only short-form filings. In 2024, leadership changed, with Frank Farance now serving as president. Frank has taken on the challenge of reviving an organization that, after years of decline, risks becoming irrelevant. His bid to secure PPF funding was part of a broader attempt to reinvigorate RIRA's community impact. The CERT Connection and a Familiar NameThe grant’s stated purpose was to develop a Community Emergency Response Team (CERT) on Roosevelt Island—an initiative led by RIRA and spearheaded by Howard Polivy, a current RIOC board member. Polivy’s official RIOC bio confirms his role as CERT chief and past RIRA representative. “Mr. Polivy has a history of civic activism. He presently is Chief of the Roosevelt Island Community Emergency Response Team (CERT) and a trustee of his local congregation. He has served the Roosevelt Island Residents Association (RIRA) as an alternate representative for his building and prior to coming to Roosevelt Island had been a coop board president.” There’s no allegation of wrongdoing. But when a sitting board member is connected to both the applying organization and the funded project, the need for transparency becomes more pronounced. Sources have suggested that Mr. Polivy’s wife may be involved in RISA, the fiscal sponsor used by RIRA. We have not been able to verify this information, nor have we received a response from Mr. Polivy himself. These unconfirmed reports raise further questions—especially given RISA’s expanded role this grant cycle and its troubling history. As of publication, Mr. Polivy has not updated his official RIOC biography to reflect any current involvement with RISA, CERT, or RIRA beyond what was previously listed. In a system where personal affiliations and public funding can intertwine, transparency isn’t just preferred—it’s necessary. Fiscal Sponsorship and the Missing StandardsRIRA applied through RISA/Good Life, a 501(c)(3) fiscal sponsor. Fiscal sponsorship is a legitimate pathway used by some nonprofits, though it is relatively rare. When done correctly, it provides a legal framework for projects that lack their own 501(c)(3) status to receive funding under the oversight of an established public charity. A clear example of this model working properly is iDig2Learn, a long-time Public Purpose Fund recipient. iDig2Learn is not a standalone legal entity—it operates as a project under the Open Space Institute (OSI), a registered 501(c)(3). In that case, OSI assumes legal and financial responsibility, provides oversight, and ensures accountability for the use of public funds. That is not the case here—at least not transparently. While RIRA, to its credit, responded when questioned, its sponsor—RISA—has remained silent. In a follow-up, Farance explained that the funds were distributed to RISA, which in turn disburses them to RIRA. He described the fiscal sponsor’s role as ensuring the funds are used as intended, with RIRA providing documentation and close-out reporting—effectively mirroring the accounting responsibilities of a direct grantee. There is no public documentation showing that RISA has formally assumed oversight or legal responsibility for the grant. RISA was previously implicated in a felony fraud conviction. There has been no formal acknowledgment of restitution, and yet the organization reappeared this year both as a grant recipient and as a fiscal sponsor. Without confirmation that RISA is fulfilling its legal obligations as a sponsor, and with no public disclosures to back it up, this case risks appearing less like a sponsorship—and more like a circumvention. In that context, transparency is not just a courtesy—it’s essential to public trust. Loopholes and Uneven KnowledgeWhat’s becoming clear is that certain nonprofits—those familiar with the process—identified ways to maximize their Public Purpose Fund awards by using structural workarounds. Two strategies stand out:

This tactic appears to benefit organizations that know the system well. Instead of bundling all their community work into a single application, they diversify their ask—splitting projects into multiple line items to increase funding opportunities. RIVAA, for example, received two separate grants totaling $40,000. Tango classes appear to have secured their own allocation, rather than being housed under an existing nonprofit. And now, with the sponsorship pathway, RIRA’s $10,000 grant arguably expands RISA’s financial reach. Meanwhile, nonprofits not in the loop—those unaware of these tactics—submitted more traditional applications and received less. Some were denied entirely. Whether intentional or not, the disparity points to an ecosystem where insider knowledge determines outcomes. And that, more than anything, threatens the public trust these funds are meant to uphold. A System in Need of ReformPublic funds require public accountability. The NYS Attorney General’s Charities Bureau, the State Comptroller, and the Office of the Inspector General all have jurisdiction here. Yet when we requested clarification from NYCT, RIOC, and other involved parties, we received little more than silence. RIOC offered a non-substantive reply. The Trust declined to provide further information on several grants. Some questions remain unanswered. RIRA, as it seems, followed the process. Yet the spirit of the rules—the intent behind excluding 501(c)(4) organizations from benefiting directly from public purpose funds—remains valid. And if, as the process requires, RISA received those funds on RIRA's behalf, that would suggest RISA received an even larger allocation than previously understood. Unfortunately, we cannot confirm this because the Trust has declined to clarify and RIOC has shielded itself behind legal counsel. We do not expect public funding to operate smoothly without clear oversight and full transparency. And in the absence of both, it is often the most vulnerable and mission-critical nonprofits—those least positioned to game the system—that are left out. That failure harms not only the organizations, but the causes and communities they serve. RIRA, under the leadership of Frank Farance, is clearly fighting to make a comeback. We respect that. We also respect and acknowledge his open and direct communication—an example of civic engagement that others in positions of power would do well to follow. We further appreciate that RIOC CFO Dhruvika Patel Amin advocated to increase overall allocations in a tough funding cycle. But good intentions are not enough. The system must be rebuilt to ensure clarity, equity, and integrity. Until then, we’ll keep documenting. |

Friday, 20 June 2025

RIRA’s Return: Transparency Amid a Fog of Exceptions

Subscribe to:

Post Comments (Atom)

Why the Paracetamol–Autism Panic Isn’t About Science: It’s About Control

The Not So Quiet Dehumanisation Of Autistic People ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Online & In-Person ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Dear Reader, To read this week's post, click here: https://teachingtenets.wordpress.com/2025/07/02/aphorism-24-take-care-of-your-teach...

No comments:

Post a Comment